To obtain an SBA 504 bank loan, you must satisfy the SBA’s least requirements and needs from your CDC and lender. Lender necessities will vary but could be aggressive mainly because 504 personal loan borrowing expenses and repayment conditions are desirable.

This is actually the amount of money that you’ll borrow from your SBA lender. Whilst bank loan quantities range, Every single SBA loan form is topic to a optimum funding Restrict.

This also decreases administrative duties by eliminating the necessity for shareholder conferences and votes. Also, loans Never require exactly the same regulations on investments. What variety of information do I want to offer to make an application for a business loan?

House loan calculatorDown payment calculatorHow Substantially household can I afford to pay for calculatorClosing costs calculatorCost of residing calculatorMortgage amortization calculatorRefinance calculator

Just how these SBA loan prices are calculated is really rather complicated. In short, the interest rates around the CDC portion of the mortgage are depending on the current rate for U.

We aim to provide precious content material and beneficial comparison capabilities to our people through our totally free on the internet source. It's important to note that we acquire promotion compensation from companies showcased on our internet site, which may impact the positioning and buy through which brand names (and/or their goods) are shown, together with the assigned rating. Make sure you be aware the inclusion of business listings on this website page would not suggest endorsement.

The specialized storage or obtain is needed for the legitimate intent of storing Choices that aren't requested through the subscriber or consumer.

This could have an affect on which expert services look on our site and wherever we rank them. Our affiliate compensation lets us to keep up an advert-free website and supply a no cost company to our viewers. To find out more, be sure to see our Privateness Coverage Web site.

To secure the most beneficial business personal loan fitted to you, ensure the repayment terms align using your fiscal planning. What sort of small business financial loans are offered?

SBA 504 more info loans are An economical selection for funding machines and real-estate buys — if you can qualify.

This getting stated, however, this SBA personal loan down payment is about half of what banks ordinarily require for standard loans.

The SBA 504 bank loan system demands a down payment of a minimum of 10 percent. In the event you’re a startup small business or receive Homes for any Particular reason, you could be needed to put down more money to the financial loan.

So how can we earn cash? Our partners compensate us. This could influence which items we evaluate and create about (and wherever those items show up on the internet site), however it under no circumstances influences our tips or advice, that happen to be grounded in Many several hours of study.

You'll find several options for funding your organization. Under are a few of the most typical types of small business financial loans:

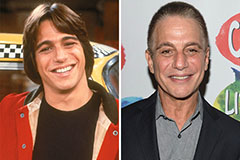

Tony Danza Then & Now!

Tony Danza Then & Now! Daniel Stern Then & Now!

Daniel Stern Then & Now! Tahj Mowry Then & Now!

Tahj Mowry Then & Now! Brandy Then & Now!

Brandy Then & Now! Jennifer Love Hewitt Then & Now!

Jennifer Love Hewitt Then & Now!